Are you considering improving your home or did you already? If you make or made any energy-efficient improvements this year, you could put money back in your pocket! Here’s how you can get up to $3,200 in tax credits while also reducing your electric bill.

What Exactly Qualifies?

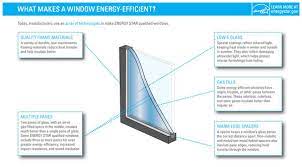

So, what can you get credit for? Things that improve energy efficiency! From insulation to new windows and doors that keep the weather outside, you could be looking at a tax credit worth 30% of your qualified expenses. This includes certain improvements made from Jan. 1, 2023, onwards, right through to 2032. Read more here.

The Nitty-Gritty of Credits

Of course, there are limits to what you can claim. Here’s the breakdown:

- Up to $1,200 for energy property costs and specific energy-efficient home improvements, with caps on doors, windows, and home energy audits. ($250 per door and $500 total), windows ($600) and home energy audits ($150)

- $2,000 per year for qualified heat pumps, biomass stoves, or biomass boilers.

Bonus: there’s no lifetime limit on this credit! So, keep making eligible upgrades until 2033 because you can claim the maximum annual credit every single year.

Who’s Eligible?

The bad news is you gotta spend money to save money. But if your house is not energy efficient you are currently wasting money every month! To qualify for these credits , these improvements must be made to your main, already built home, located in the U.S. Usually, this credit is for folks who live in the home for the majority of the year.

Digging into the Details

Anything you install needs to meet energy efficiency standards and be purchased new to get the credits. Read the labels and fine print before you buy.

- All new doors, windows, and skylights must meet Energy Star requirements.

- Insulation and air sealing materials must meet specific energy conservation codes.

However, labor costs for installing these components won’t count towards the credit.

How to Claim Your Credits

Ready to dive in? When you’re all set with your energy-efficient upgrades, file Form 5695, Residential Energy Credits Part II, along with your tax return to claim the credit. You must claim the credit for the tax year when the property is installed, not merely purchased.

Can’t afford new stuff? Tips to save money

Even if you don’t want to follow the rules to qualify for these specific credits, making your home more energy efficient will save you a lot of money over the years on your heating and cooling bills. So be sure to seal up those leaky doors and windows and replace any old appliances. Newer appliances must meet stricter every use requirements. Wrap or replace old water heaters and turn off unused second refrigerators or freezers. Turn the temperature down a little on your water heater. And use the energy saving settings on your washer and dryer. Don’t wash and dry clean clothes more than once . Limit use of space heaters and window units because they tend to use more energy than central air and heat.

For more detailed information, see https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

As I learn more about taxes, I’ll be sharing helpful information with my friends. Have a great day!

We put solar panels on our roof in March and we are NOT getting the savings promised. I spoke to a friend who said they are experiencing the same thing. I think our electric company raised their rates and they are not paying us for our generated electricity what they are charging. I need to do more research.

You’re not getting the tax credit ?

We got the tax credit. We aren’t getting much of a monthly savings.

I bet you’re right that they raised the prices.

I’m sure they did. But not the price they pay us for generated electricity.

https://www.irs.gov/credits-deductions/frequently-asked-questions-about-energy-efficient-home-improvements-and-residential-clean-energy-property-credits-residential-clean-energy-property-credit-qualifying-expenditures-and-credit-amount

Thank you. We took a $10k deduction which was helpful. I’m upset we were promised half the monthly bill to zero and are only getting $60 a month off with a bill well over $200.