Why do half of workers say that they will have to work until they die? Inflation and low wages are only part of the story. The other part is that the American public education system has neglected to teach financial literacy skills to every student before they enter the job market. My research shows that American schools are attempting to remedy this , however, the teachers themselves report not being financially literate or confident about teaching the subject.

As the book Rich Dad, Poor Dad by Robert Kiyosaki and Sharon Lechter explains, children who learn to use money as a tool are at a great advantage over those who don’t. A few kids might be lucky enough to enroll in a class on how to use money like rich people do, but the vast majority are expected to learn that at home. Sadly, most don’t learn the financial skills they need from their parents, such as how to use credit, invest, and start a business and are likely to never understand how to manage their money to their advantage.

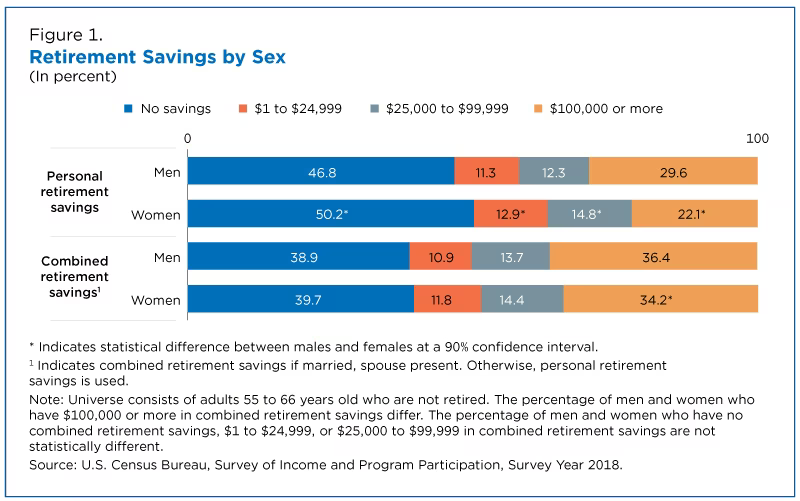

While many professional boomers have retired and are living the good life now, older non-professionals workers are faced with having to keep working despite their aging bodies and minds. Their lower incomes did not keep up with the rising cost of living and they never felt they could save for retirement. According to The Guardian, as many as half of workers who had the opportunity to put money in a retirement fund, which means they had a somewhat decent job, did not do it because they couldn’t spare the money. They are now regretting not finding a way to save.

The economy has ratcheted up prices of basic necessities to match the incomes of the upper third of the population. This professional, publicly funded, and investor class has no problem paying for $4/gallon gas and $400,000 houses. Meanwhile, the lower two thirds are struggling to survive. Homelessness, escape into drugs, and adult children living with their parents is increasing.

As for the future of the boomers and older Gen Xers, I really don’t know how the millions of workers with no retirement funds are going to survive. I envision people banding together, sharing houses, needing to help each other. The government is not doing anything to prepare, that I have seen, for the coming social security time bomb , and increasing numbers of older people with health problems that end up as wards of the state in nursing homes, homeless on the street, or wandering with dementia. This is going to be a real problem.

A New Economy

America’s free market system is in crisis. It is becoming much more difficult for small to medium businesses to stay profitable due to the power of multinationals to sell at lower prices. Because of this, ‘working for yourself’ is not as appealing as it once was. A growing number of people are choosing government jobs, such as the education system, the government healthcare system, colleges, grant-funded organizations, government-funded science industries, and other subsidized industries because these jobs often provide benefits and retirement.

This difference in pay and benefits between the private-sector and public jobs has created a two-tiered class system. There is also a big difference in how red and blue states compensate workers. This became a problem when prices began to increase in the blue states, dragging up prices nationwide. In other words, the socialism of the blue states is also hurting the economy in of the red states. National socialism is being rolled out unevenly. Red states don’t want it, but it still affects us. For example, Texas has very limited Medicaid while New York has socialized medicine.

Upward social mobility, or doing better financially than your parents, is decreasing in this country. Today’s economy is not the same as it was in the 50s. Food, shelter, health insurance and transportation are taking a much bigger bite out of paychecks. Boomers and Gen Xers, like myself, need to stop thinking that young people today are living in the 80s and 90s economies. Everything about America has changed since 9/11 and the release of the internet, and many years of cheap money did not level the playing field for those who do not know how to use money.

Conservative Christian parents have taught their children their values, but not necessarily the financial literacy or career choices that they need to live them out. It takes money to help the less fortunate and time to raise a family. Money is often seen as ‘worldly’ or even evil and the rich are vilified. So hard-working, loving parents end up raising children who are at risk of living a life of financial struggles and unable to afford a house or children. But money is not inherently evil. It’s all about how you use it. Responsible parents must start teaching their kids how to navigate the world of money.

Financial Literacy

Our economy was built on encouraging people through constant marketing to BUY, not INVEST and SAVE. Financially savvy people learn how to profit from the free market system. The rest of us become workers living paycheck to paycheck and consumers living above their means using credit cards and loans. The solution is to educate yourself and teach your children how to manage money, start and grow a business, use credit as a tool, invest in the right things, and turn money into a money machine, just like the rich teach their children. And if you also teach them how to work hard, have good character, and care about their fellow man, you’ll help save this country from collapse.

Here are five key components of financial literacy, or how to use money wisely, that everyone should know:

- Budgeting– This is the opposite of simply getting paid and spending it until you run out. You should know how much money you have coming in and going out and plan ahead how you will spend it. Our government has set a terrible example in this area by not staying within a budget and by encouraging people to live above their income and live paycheck to paycheck.

- Saving– Put aside part of every paycheck. This is where you start to actually manage your money. Rather than hoping for the best, you intentionally save money for things like maintenance, education, illnesses, and retirement. Saving also includes simply NOT buying things you can’t really afford on your current budget and finding ways to grow your money by earning interest.

- Managing debt– Not all debt is bad, sometimes you need to go into debt to achieve goals, but you must be in control of it and find the best interest rates and make your payments on time or early.

- Investing– This skill can make the difference between being rich and being poor. It will be well worth your time and effort to learn about stocks, bonds, currencies, and other opportunities to use your money to make money for you. Even if you have very little money you can get started by educating yourself and saving up so you can invest later.

- Managing credit– Guard your credit score! Having a very good credit score gives you power over your life that people with poor credit do not have. Using credit will put you in debt, but credit also gives you money to achieve goals. The rich know how to use credit to their advantage.

- Choosing a career- This should actually be number one in this list. Before you can manage your money, you have to earn some. Choosing a career where you can successfully earn enough money to save, invest, and share is the key to all the other points. Unfortunately, the public schools also do a terrible job at preparing students for careers.

- A positive attitude– You can do this, but it is up to YOU to do the work, get the skills, get the education, the license, the experience, the network to be successful. Do not expect anyone to do it for you or even help you. This is a competitive world. The American Dream will remain a fantasy without hard work, determination, patience, and character. And it is often true that fortune favors the bold, and that God helps those who help themselves. Spend more time learning and solving problems than you do complaining about your problems.

You can learn much more about these topics by doing a search for financial literacy.

If you are one of the millions living paycheck to paycheck, you can start working on improving your situation. Here are some suggestions for the older folks. I plan to start looking for some short-term investments. You can try YouTube for learning to invest, but use caution as most of them are selling something. Here is a video I found about using the Robinhood app. Anyone can start by opening a savings account and start putting as much money as you can into a long term investment while you have time. Good luck!

I’m going to fault parents. I just helped my daughter open both a money market account and a Roth IRA. I told her how much she should put into her Roth a year for best return and what type of funds will help her. And she also had a whole semester of personal finance in high school. Last week her TFA job literally had them take out pellets of rice to show how they should budget. People aren’t saving because they think instant gratification as opposed to long term goals.

My parents didn’t teach me money skills and I didn’t learn . Actually they taught me how to use credit cards, coupons and shop sales, not save . But I don’t blame them. They were both young and poor when they got married.

Here’s what I told my daughter. One credit card for now. Don’t get enticed by store cards because it’s easier to keep track of spending when you limit cards. I told her eventually she’ll want an Amex, but then stop at two cards. I told her to pay off her balance every month and check her statement at least once a week to keep track of what she spends. I told her on the first of the month you put a certain amount in money market and a certain amount in Ira. This money is short and long term savings and shouldn’t be touched except emergency. My husband helped her create a budget to see how much she can spend and on what. She is lucky in a bizarre way to see what happened to my father in law who never was fiscally responsible (multiple bankruptcies, foreclosures, etc) and learned why it’s important

👍Y’all raised her very well!

👍

Socialism is far from the problem here. It is capitalism.

I believe it was John Maynard Keynes who said the ultimate goal of corporations was to maximize shareholder value. Not to provide for the social good or to pay their works a living wage.

If corporations paid their workers a living wage, the workers would not need welfare to feed their kids. Tax payers are subsidizing McDonalds and Walmart and every other low paying employer.

If corporations paid taxes like we do, we would have schools with the budget to teach basic finance. Yes, it does take money to get someone to make the career choice to teach any subject.

Corporations are doing what the system allows them to do, screw their workers and pay little to no taxes. Sounds like corporate socialism to me.

I agree that government-funded and created corporate fascism is the problem but that’s not the same thing as capitalism. Big Government is the problem. It may be an inevitable phase before the end of freedom or it may be caused by unscrupulous politicians. Erecting social safety nets seems good in the short term but in the not very long term those nets become a trap. The real problem, that no one ever talks about, is that politicians use their power to help corporations and state agencies get better deals , this creates an unequal set of conditions, in other words , people who aren’t in that group cannot compete . This started with farm subsidies. The whole economy is a sham now. It’s only a matter of time until every business is owned by multinationals and subsidized by taxpayers. This is not a left/right issue. This is a mafia plan.