Is your job taking enough out for taxes?

As a tax preparer, I have had to share the bad news with quite a few people that they OWE the IRS money instead of getting the REFUND they expected. This usually happens for one of two reasons.

- They did not understand how to read the tax section of their paycheck so they didn’t realize that very little or no taxes were being withheld.

- Or, their dependents grew up and now they no longer receive the Earned Income Credit or the Child Tax Credit that used to provide them a large refund or at least cancel out their taxes owed. They previously had more tax deductions.

The number one reason is the first one. People think that ‘taxes’ are being taken out when they see Social Security and Medicare amounts on their paystub. Unfortunately, those taxes are not the same as taxes on your income which should be found in the Federal Withholding Box. *It might just say FED or Withholding, not every paystub is the same.

Quick summary: Make sure at least 10% of your paycheck is taken out for FEDERAL WITHHOLDING. For higher or double incomes, you must have more taken out. See charts.

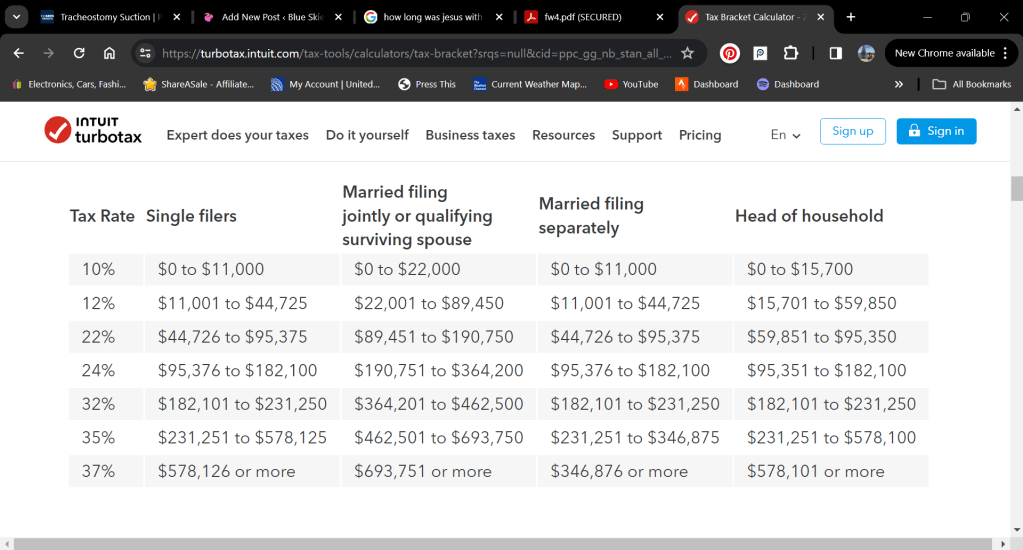

It is the Federal Withholding that goes to the IRS for your income taxes. If you do not have dependents, or cannot claim them for some reason, or you have a very high income, you could be hit with a large tax DEBT, meaning you owe money, if you don’t have AT LEAST 10% BEING TAKEN OUT of every paycheck. If you make over a certain amount, that percentage goes up, so check the chart below to find your tax bracket. But remember that the numbers on the chart are after your TAX DEDUCTIONS.

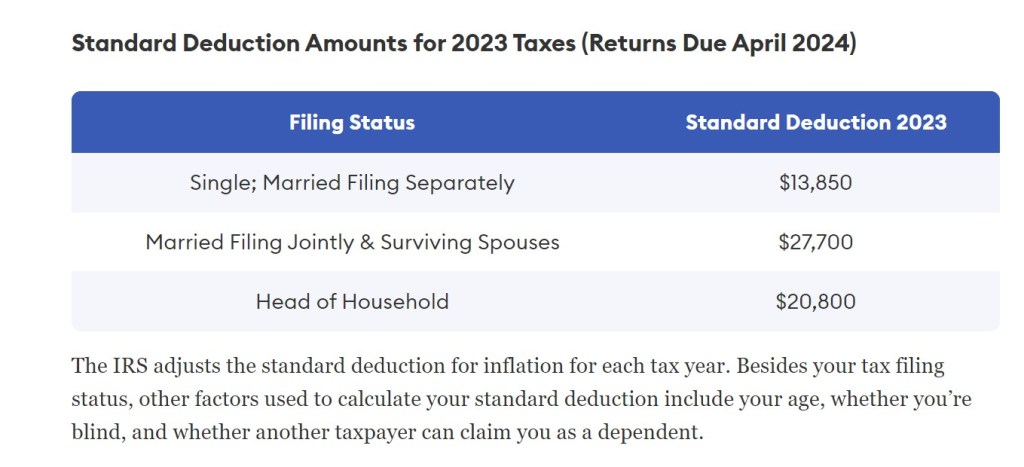

Tax deductions reduce the amount of income that you pay taxes on, and everyone who is not a dependent for someone else qualifies for at least the standard deduction listed below. Some people get more if you are blind, or over 65. Also, you can choose not to use the Standard Deduction if you want to Itemize your deductions. This can be helpful if you just bought a house, have high out of pocket medical expenses or a few other things. Your tax preparer or tax software should determine which one is best for you if you enter in these figures.

Can someone claim you as a dependent?

If someone is claiming you as a dependent, your deduction is figured differently. Per the IRS, f you can be claimed as a dependent by another taxpayer, your standard deduction for 2023 is limited to the greater of: (1) $1,250, or (2) your earned income plus $400 (but the total can’t be more than the basic standard deduction for your filing status). Example: You earned $6000. You can deduct all of that from your taxable income, plus $400 and get a refund if you had any federal withholding. But if you earned $20,000, you can only deduct $13,850 from your taxable income.

The Problem is often the W-4

To avoid an unwanted surprise, you must be sure your W-4 is filled out correctly. However, the new form is quite complicated and does not always result in the desired amount being withheld. Many people have stated that they ‘claimed zero’ on their W-4, and still no Federal Withholding Taxes were taken out, or very little. They bring their W-2s to us and we look at them and we say, uh-oh, if they have no dependents, because we can tell that they will owe. I think the payroll companies must have changed how they calculate the amounts per check, but I am not sure why this is happening to people who claim zero dependents. It seems to happen to people who have smaller paychecks, so my guess is that if your weekly check is low enough, federal taxes don’t get triggered. But you can overcome that with the following method.

The solution

The best way to make sure enough is taken out is to redo your W-4 and in Step 4, letter C, write down a dollar amount that you want your employer to take out each week. You want to take out at least 10% for a lower paying job, or 12% if you have no dependents and you have TWO JOBS or are married and both spouses work. 10% may not be enough if you have TWO JOBS. The 10% or 12% question depends on your total taxable income. See the chart below for tax brackets on taxable income. Remember these numbers are AFTER deductions. Another option that works for some married couples is for both spouses to choose SINGLE on their W-4s. But this doesn’t always work, so be sure to check the amount being taken out.

For example, look at your last paystub. If you made $300 and they took no FEDERAL taxes out, and $300 is about the usual amount of your paychecks, then multiply that $300 by 10% and you get $30. Write $30 on letter C. If you are married and your spouse also works and makes $300 per check, they should also have $30 taken out. But if your total monthly income , your check and their check, is more than $50,000 that will put you in the 12% bracket after your standard deduction of $28,700. You need a good estimate of your annual TAXABLE income after deductions. If you itemize, your deduction could be more.

If you are single with no dependents, and especially if you work full-time or multiples jobs, or if you have any side jobs that are not taking taxes out and will give you a 1099, I highly recommend taking 12% out to be safe. But you can figure the amount you need to have withheld based on your income from the chart.

Note that if you do have dependents and/or a very low income or only work part-time, and/or you qualify for tax credits, you might not have to have a lot taken out. For example, if you are single and make less than $13,850, you do not have to pay any taxes because that is the standard deduction amount. But remember this can change if your income goes above a certain level because tax credits phase out in some cases based on income. Do not risk owing taxes. Calculate how much you need to take out. The worst case scenario if you take out more taxes than necessary is that you would get a big refund.

Example:

For example, based on the tax bracket chart below, the amount of Income over $44,726 is in the 22% bracket. But that is after deductions, so if you earn $45,000 on your Year To Date on your paycheck, you should have about $3,533 taken out to avoid owing money and get no refund. This would mean that the first $11,000 of your income is taxed at 10% and the next $33,726 at 12% and the rest at 22%. However, if no one claims you as a dependent, you will reduce your taxable income off the top with the Standard Deduction of $13,850 for Single filers, meaning that only $20,000 of your income is taxes at 12% and $150 at 22%. The Standard deduction doubles for Married Filing Jointly filers. But, to be safe, in case you get a raise or have untaxed overtime, if you are close to the 12% bracket, you might want to go with that. Unless you are contributing to a Retirement plan which can also reduce your taxable income and even give you Saver’s Credit if your income is not too high. But if your income is as above, and if you have 10% taken out, you would get a small refund.

Let’s calculate the taxable income after deducting $13,850 from $45,000 and then proceed with the tax calculation:

- Calculate Taxable Income after Standard Deduction:

- Standard Deduction for Single filers = $13,850

- Taxable Income = Earned Income – Standard Deduction

- Taxable Income = $45,000 – $13,850 = $31,150

- Calculate Tax for Each Bracket:

- The first $11,000 is taxed at 10%.

- The next $34,000 is taxed at 12%.

- The remaining amount (Taxable Income – $45,000) is taxed at 22%. Let’s calculate the taxes:

- Tax on the first $11,000 = $11,000 * 10% = $1,100

- Tax on the next $20,000 (taxed at 12%) = $20,000 * 12% = $2,400

- Remaining Taxable Income after the 12% bracket = $31,150 – $11,000 – $20,000 = $150

- Tax on the remaining income (taxed at 22%) = $150 * 22% = $33

- Total Tax Liability:

- Add up the taxes from each bracket:

- Total Tax = Tax on the first $11,000 + Tax on the next $20,000 + Tax on the remaining income = $1,100 + $2,400 + $33 = $3,533

- Amount Withheld on Paycheck:

- To avoid owing money and getting no refund, $3,533 should be withheld annually.

- This means the remaining amount after withholding is: $45,000 – $3,500 = $41,500

- Check if the Withheld Amount Matches Tax Liability:

- If the withheld amount equals the calculated total tax liability, there will be no refund or owed money.

Paying Taxes As You Go

The IRS expects us to pay taxes on our income as we go, in other words, pay now, not later. By law, you need to have taxes withheld if you know that your credits will not cancel them out. If you don’t pay taxes during the year, and then owe a lot, they can actually charge you a penalty for underpayment of taxes. If you know you will owe, and your employer or 1099 job does not take out taxes, you must make estimated tax payments to the IRS during the year that you work. If you are self-employed, and you expect to owe taxes, you should go to the IRS website and make estimated payments.

omygoodness, it is as if they WANT you to make a mistake.

The new form is awful . But even when done right it doesn’t always result in the payroll company taking out enough.